Follow the Money: Understanding the Importance of Anti-Money Laundering

Money laundering is a critical issue with global ramifications. Criminal organizations use it to fund their operations, including drug trafficking and terrorism, while legitimate businesses and financial institutions can suffer reputational damage and even legal consequences. To combat this problem, various anti-money laundering (AML) regulations and compliance frameworks have been developed. This article will explore the basics of money laundering, the consequences of this financial crime, red flags of money laundering, and AML regulations and compliance to keep in mind as a financial professional, compliance officer, corporate executive, or law enforcement.

Understanding Money Laundering

The definition of money laundering is the concealment of the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses. Key terms in the process of money laundering include dirty money, which has been obtained illegally or through criminal activity, and clean money which appears to have been obtained legally and has no traceable connection to criminal activity. Some processes used to launder dirty money include placement, which involves placing illicit funds into the financial system by depositing them into bank accounts, buying money orders or traveler's checks, or making other cash purchases.

Layering involves separating illicit funds from their illegal source by creating complex layers of financial transactions, making it difficult to trace the original source of the funds, and integration is the reintroduction of laundered money into the economy as legitimate funds. Structuring involves making multiple small transactions instead of one large one to avoid detection by financial institutions or law enforcement agencies, and smurfing is the technique of fragmenting large sums of money into smaller amounts and then depositing those funds into multiple accounts. Other techniques include trade-based money laundering, cash smuggling, virtual currency, hawala, reverse money laundering, and real estate laundering.

Consequences of Money Laundering

Money laundering is a serious problem that affects everyone, whether you realize it or not. It's a crime that can have devastating consequences, not just for the individuals involved, but for entire communities. Criminal organizations use money laundering to finance their illegal activities, such as drug trafficking, corruption, gambling, and terrorism. By cleaning dirty money, they're able to fund illicit operations, often with no traceability.

Money laundering is also a key facilitator of human trafficking and human smuggling, which are growing problems worldwide. Traffickers and smugglers use laundered funds to pay for transportation, bribes, and other expenses, making tracking and prosecuting them difficult. Money laundering can also impact legitimate businesses and financial institutions. It can damage organizational reputations, lead to fines and sanctions, and even put organizations out of business.

Signs of Money Laundering to Watch For

There are a number of red flags that accountants, bank tellers, and even retail cashiers can look out for as a signal for money laundering behavior. If a customer or transaction involves an unusual source of wealth, such as unexplained inheritances, large gambling winnings, or sudden spikes in income, it may be a sign of money laundering. Keep an eye out for unexplained relationships between customers or third parties involved in a transaction. These relationships could be a sign of a complex money laundering scheme or a shell company being used to obscure the true ownership of the funds.

You can also watch for customers who insist on using unusual payment methods or those that are difficult to track, such as prepaid cards, cryptocurrencies, or money orders. Cash transactions are often associated with money laundering because they are difficult to trace. Be cautious of customers who make large cash deposits or withdrawals, especially if they do so frequently or inconsistently. Observe customers' behavior when conducting transactions. Unusual or nervous behavior may indicate that something is amiss. Also keep an eye out for transactions that involve multiple transfers, especially those that appear to be unnecessary or lack a clear business purpose.

AML Regulations and Compliance

Although money laundering is a worldwide issue, regulations may vary from nation to nation. In the U.S., the Financial Crimes Enforcement Network (FinCEN) is a bureau of the Department of the Treasury responsible for administering and enforcing anti-money laundering laws, including the Bank Secrecy Act (BSA) which was signed into law in 1970. The BSA requires financial institutions to report certain transactions to the government. Since then, the laws have evolved to keep pace with changing financial crimes. In 1986, the Money Laundering Control Act made money laundering a federal crime and added additional reporting requirements for financial institutions. The Annunzio-Wylie Anti-Money Laundering Act of 1992 required banks to establish anti-money laundering programs.

In response to the September 11th terrorist attacks, The USA PATRIOT Act of 2001 added more provisions to combat money laundering, including the creation of FinCEN. The PATRIOT Act was later supplemented by the Foreign Account Tax Compliance Act (FATCA) of 2010. Most recently, the Anti-Money Laundering Act (AMLA) was signed into law in 2020. This law made significant changes to the anti-money laundering framework. It expanded the definition of money laundering, increasing penalties for financial crimes, and requiring beneficial ownership disclosure. The history of anti-money laundering laws in the United States is a constantly evolving story of adapting to new challenges and threats.

Anti-Money Laundering Reports

If you or any of your employees directly handle money in the business, it is important to know the appropriate steps to take when reporting potential money laundering activity. First, document the suspicious activity by writing down any details that you can recall, including the date and time of the activity, the individuals involved, and any other relevant information. If you have any documents or evidence to support your suspicions, such as bank statements, invoices, or other records, provide them to the appropriate authority.

Depending on the nature of the suspicious activity, you may need to report it to different authorities, such as directly to a financial institution involved or to FinCEN. If the activity involved a business, you can report it to the relevant financial action task force agency or law enforcement. Financial institutions and designated reporters are required to file SARs and must follow Bank Secrecy Act (BSA) filing regulations. If you suspect money laundering, you can report it to your bank or other financial institution, which will then file a report with the proper agency. When a financial institution submits suspicious activity, it is called a Suspicious Activity Report (SAR). BSA regulations require that a SAR be filed if there is a known or suspected violation of federal law or a suspicious transaction involving at least $5,000.

What’s Next?

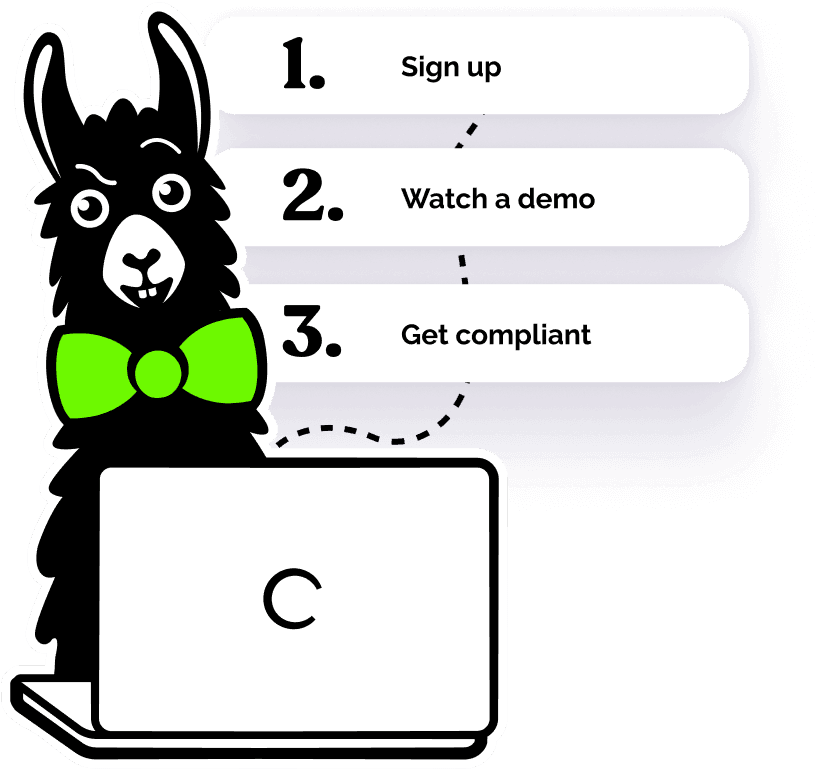

By understanding the importance of AML and working together to prevent it, we can build a safer and more secure world. If your company is at risk of experiencing or witnessing money laundering, it is important to provide your employees with Anti-Money Laundering training. With EasyLlama’s AML course, your employees will gain an understanding of anti-money laundering strategies and regulations, empowering them to navigate the intricacies of the financial landscape and improve the security of monetary transactions. Learn more about the interactive quizzes and real-life videos that we use to improve knowledge retention for our training with a free course preview today!