Who is an Insider?

Let's look at who can be considered an insider according to SEC 10b-5. It is a common misconception that insiders are CEO's or high level officials that can manipulate a stock price by making large trades, but that's not quite true. In this chapter, we will find out that insiders can appear in many forms.

What is Fiduciary Duty?

Did you know that a fiduciary must act in a way that will benefit someone else financially? If you have access to MNPI, you have a fiduciary duty to the public markets to refrain from trading based on that information.

Insiders are anyone with access to MNPI

Anyone who has access to MNPI can be considered an insider and has a fiduciary duty to keep that information private until it is released to the public. Anyone who has access to MNPI can be considered an insider and has a fiduciary duty to keep that information private until it is released to the public.

According to the SEC, many different types of people can be considered an insider. Let's look at some.

Insiders can even include a friend or family member who receives a tip based on MNPI, Remember, anyone with access to MNPI is considered to be an insider.

Politicians with access to government decisions regarding finance and the economy can be considered insiders.

Insiders within the company can include a CEO, board member, or employee of a publicly traded company.

Insider Trading comes in all sizes

Not all insider trading cases that the SEC addresses involve large dollar amounts. Some of the smaller amounts the SEC has ever prosecuted include one case in 2016 where an individual was found guilty after netting only $1,083 in illicit profits.

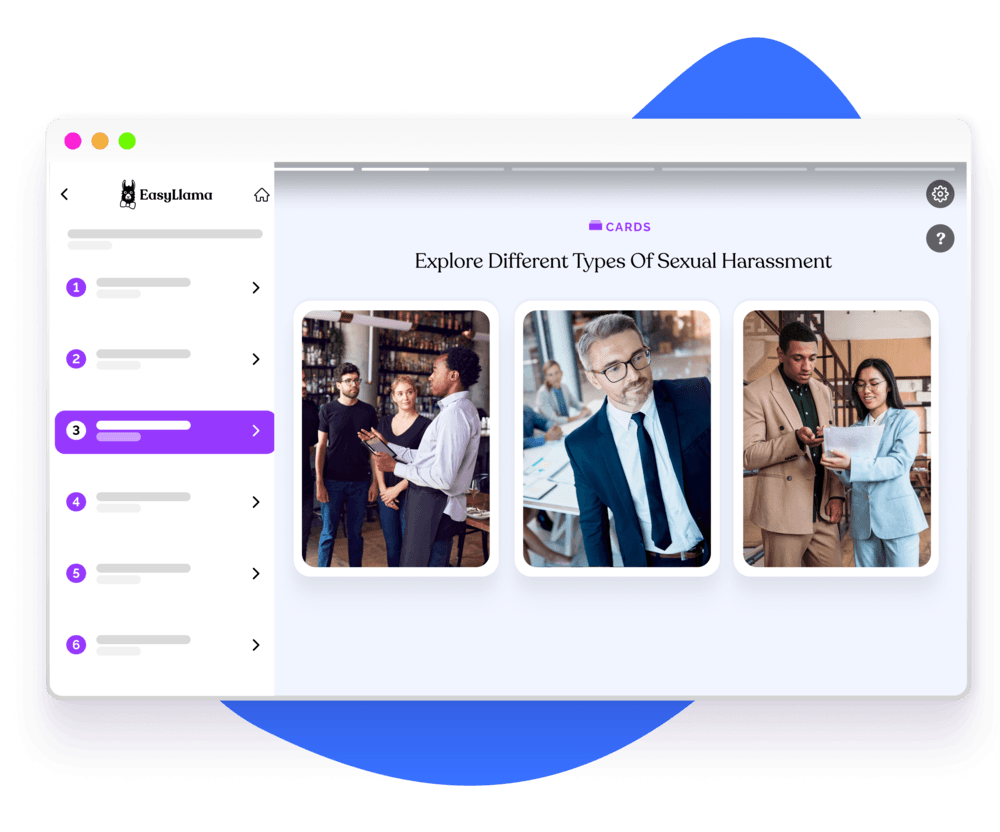

Examples of Insiders

Can you identify these examples of an insider at a public trading company (and beyond)?

Here are some myths to look out for:

- -

Employee of a company

- -

CEO of a company

- -

Politician or government worker

- -

Anyone with access to MNPI

Avoid breaking the law by identifying whether you are an insider

Employees should be trained in insider trading laws to ensure that they do not break the law in their workplaces. This training should include an overview of the laws related to insider trading, as well as the legal and financial implications of engaging in this practice. EasyLlama’s workplace training on Insider Trading in the workplace is an engaging and modern way to keep your employees safe and on the right side of the law.

Helping over 8,000 organizations create a safer, more productive workplace

The online training course from EasyLlama walks learners through which transactions are prohibited, how to avoid them, and the procedures to follow in order to trade in public marketplaces in an ethically and legally acceptable manner. The course covers: