The Twelve Requirements of PCI DSS

This chapter will provide an overview of the twelve requirements mandated by PCI DSS, ensuring that organizations handling cardholder data maintain a secure environment.

PCI DSS Fines: Understanding the Consequences

When it comes to Payment Card Industry Data Security Standard (PCI DSS) compliance, organizations must take fines and penalties into serious consideration. Non-compliance with PCI DSS requirements can lead to severe consequences, including hefty fines imposed by card brands and acquiring banks. These fines are intended to hold businesses accountable for safeguarding cardholder data and encouraging adherence to the security standards.

These are the twelve high-level requirements that organizations must comply with to achieve PCI DSS compliance.

-

Restrict physical access to cardholder data.

-

Track and monitor all access to network resources and cardholder data.

-

Regularly test security systems and processes.

-

Maintain a policy that addresses information security for all personnel.

- Use and regularly update antivirus software or programs.

- Develop and maintain secure systems and applications.

- Restrict access to cardholder data to business need-to-know.

- Assign a unique ID to each person with computer access.

-

Install and maintain a firewall configuration to protect cardholder data.

-

Do not use vendor-supplied defaults for system passwords and other security parameters.

-

Protect stored cardholder data.

-

Encrypt transmission of cardholder data across open, public networks.

Common Security Measures

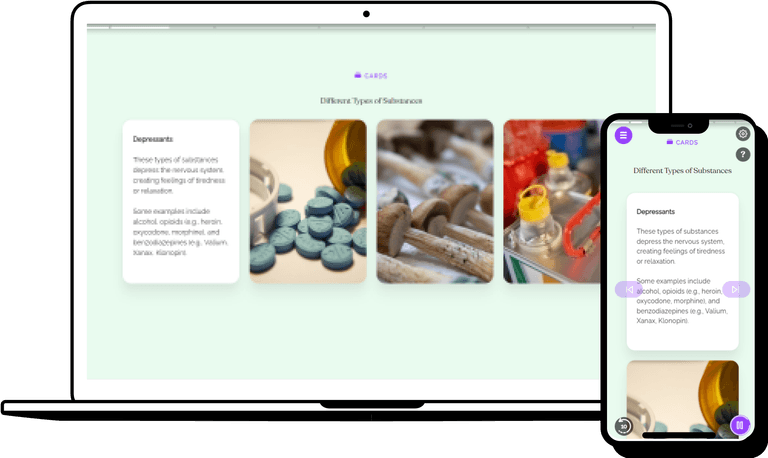

To achieve PCI DSS compliance, organizations must implement a variety of security measures. Here are some common security measures that businesses often adopt to meet the requirements:

Here are some myths to look out for:

- -

Firewalls and Intrusion Detection Systems (IDS)

- -

Data Encryption Techniques

- -

Multi-Factor Authentication (MFA)

- -

Regular Security Audits and Penetration Testing

- -

Security Incident Response Plans

Safeguard Your Organization with PCI DSS Training

PCI DSS training plays a pivotal role in fortifying your organization against data breaches and ensuring compliance with the stringent security standards. By equipping your employees with the knowledge and skills needed to handle sensitive cardholder data securely, you can mitigate risks and bolster your defense against cyber threats. EasyLlama’s training provide insights into the twelve requirements of PCI DSS, emphasizing best practices for data protection, secure system configurations, and incident response protocols.

Helping over 8,000 organizations create a safer, more productive workplace

The goal of this training is to educate employers and employees on their rights and responsibilities when it comes to PCI DSS in the workplace. This course covers: