#1 Compliance Training & Management for Financial Services

Financial institutions can easily equip their employees with the necessary knowledge to prevent harassment and improve workplace culture with EasyLlama’s comprehensive online courses.

Mission

Improve Workplace Culture, Decrease Turnover Risk

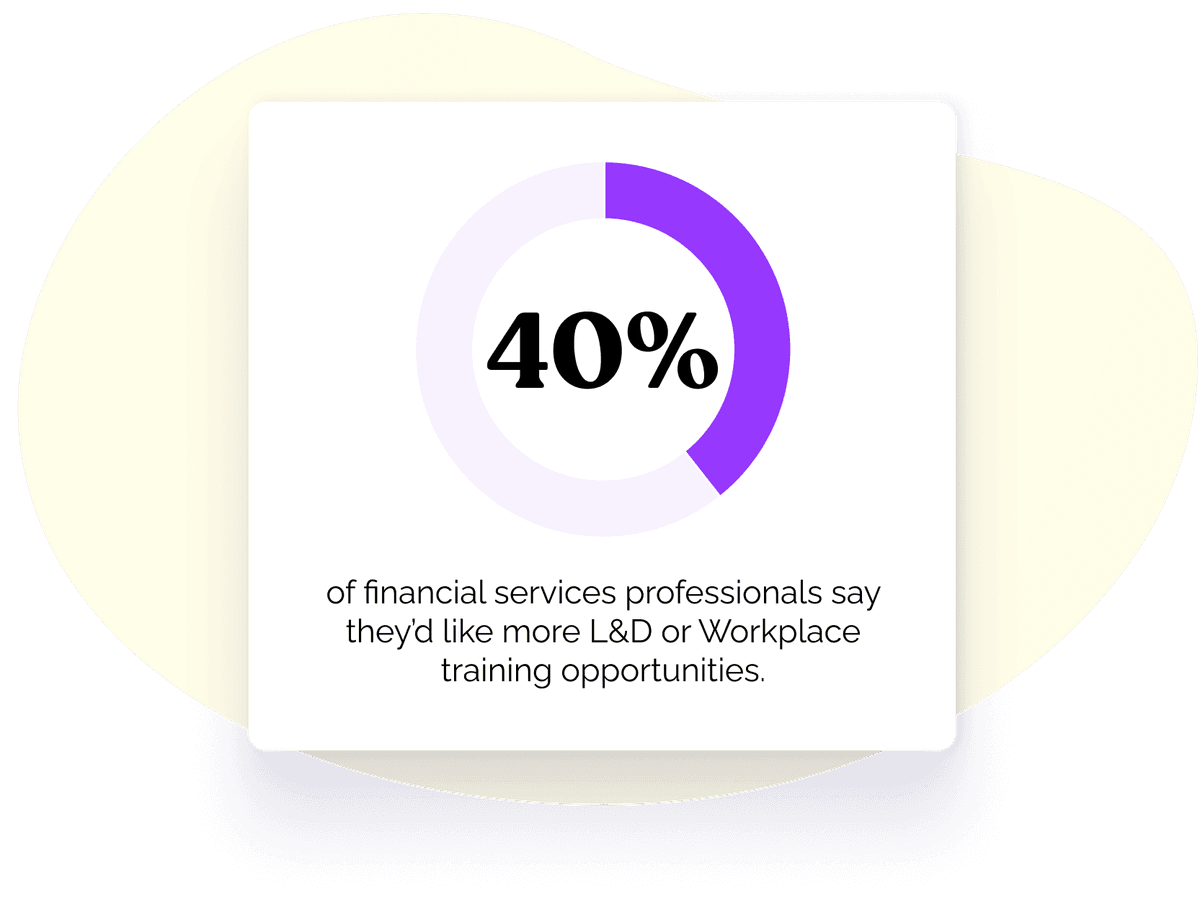

Did you know? 40% of financial services professionals say they’d like more L&D or Workplace training opportunities.

Courses Tailor-Made For the Financial industry

EasyLlama’s Unconscious Bias, Diversity & Inclusion, and Bystander Intervention online training courses can continue to educate your employees on fostering an inclusive and welcoming workplace which could lead to a boost in productivity.

See All

Why Waud Capital Partners with EasyLlama to Cultivate a Culture of Compliance

Download Case Study

Learners Love ❤️ Our Content

The EasyLlama team tailored a unique subscription to fit our unique needs. EasyLlama is loyal to its customers & everyone that works there has such a great "can do," cheerful, funny personality. The training material is up to date, aesthetically pleasing, packed with info, & is well received by our company. I love that EL added more compliance training material.

— Jane D.

Project Manager

Get started today in 5 minutes

A Personalized Course Experience For Your Financial Institution

1

Office-Specific Course Content

Our courses were curated with office-specific content and includes relatable real-world scenarios that resonate with learners who work in an office setting.

2

Custom Logo, colors, Content

Personalize your employees' training experience with our customizable platform. Access industry-specific content, set unique training frequencies for each employee, and upload your brand colors and logo.

3

Advanced Customizations

Let EasyLlama make your employees feel at home. We can collaborate on custom content creation, adding custom videos from your CEO or HR specialist, and fit each course to the needs of your employees.

Features made to solve common Financial Services challenges

Through our flexible training approach, employees can stop, start, and pause courses across a range of devices so they can complete training during quieter work periods or in between client interactions.

Helping over 8,000 organizations create a safer, more productive workplace

Empower Your People. Strengthen Your Workplace.

Schedule a demo to see how EasyLlama makes training easier, workplaces safer, and business outcomes stronger — all in one platform.

Learn more

Financial Services FAQs

- Short, frequent refreshers with real-world scenarios help employees apply rules (KYC, MNPI, privacy, acceptable use) in the flow of work, lowering incident rates and improving audit outcomes.

- Financial services organizations are typically required to provide training on anti-money laundering (AML), cybersecurity, harassment and discrimination prevention, ethics, and privacy regulations. These trainings help protect organizations from legal risks and support a culture of integrity and safety.

- Banking roles face unique risks—MNPI handling, KYC/onboarding processes, third-party risk, payments security, branch operations, and wealth-management conflicts. Industry-specific examples help bank employees connect the dots between regulations and day-to-day decisions, improving retention and exam performance. EasyLlama lets you adapt paths by role, location, and supervisory level to match actual control responsibilities.

- EasyLlama helps banks and financial institutions stay exam-ready across branches and states. Admins can auto-assign training by role and location, track completions in real time, and bulk-export certificates for regulators and internal audits. Course content is updated to reflect evolving rules and best practices (e.g., FCPA/anti-corruption, insider trading, data privacy), and is reviewed to be legally defensible, so your financial team is prepared for oversight from the OCC, FDIC, FRB, NCUA, SEC/FINRA, and state regulators.

- Admins can generate time-stamped completion reports, export certificates in bulk, and filter by branch, role, or date range. Our dashboards make it easy to evidence assignments, completions, and policy attestations during exams or internal audits—so you’re always exam-ready.

- Yes. Create role-based, location-aware learning paths and set recurring cadences. New hires, promotions, and transfers can be auto-enrolled via integrations and SSO so no one slips through the cracks.